From Crib to College: A 529 Education Savings Journey

Years of saving and investing in a 529 College Savings Plan pay off when college becomes a reality

From crib … to college!

One of the most rewarding aspects of our work is helping clients take 529 distributions for each upcoming college semester. We know that behind every distribution is the love and planning that went into saving for a child’s college—and at the receiving end of every distribution is a student beneficiary who has a great future ahead of them.

Not everyone’s education savings journey looks the same. But whether you start saving sooner or later, a 529 college savings plan can be an enormous benefit when the tuition comes due. Here’s a quick refresher on what makes the 529 plan such a great saving vehicle—for parents and grandparents—to help allay the financial stress and uncertainty of sending a child college.

The 529 Tax Advantage

Most people who are planning ahead for a child’s or grandchild’s college education are aware of the tax advantages of starting a 529 College Savings Plan*. Funded with after-tax money, your invested 529 savings grow tax free—and then, in the future, can be withdrawn to pay for a child’s qualified education expenses with no additional taxes on earnings.

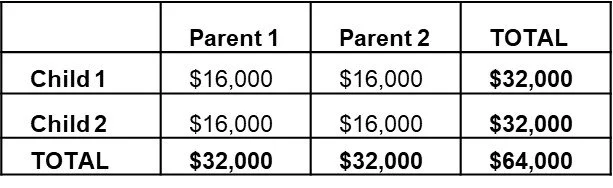

Currently, 529 account owners can contribute $16,000 per year per beneficiary (or a “bundled” contribution of up to $80,000 every five years) without triggering the gift tax. In a two-parent, two-child household where each parent opens 529 accounts for each child, the maximum annual contribution matrix looks like this:

Every state (except Wyoming) and the District of Columbia offer at least one 529 plan option. You are not limited to your own state’s 529 plan and can open a plan in another state. However, the plans can vary in their cost and quality, so it’s important to do your research. Details about each state’s 529 offerings and related tax policies can be found HERE.

Many people opt to go with their own state’s 529 plan, especially if there are associated state income tax deductions/credits. For example, here in Virginia you can deduct up to $4,000 per account per year and carry forward any excess contributions to future tax years (account owners aged 70 and over can deduct the full contribution amount in the year they contribute).

A 529 tip: If you are paying any college expenses out of pocket—as many are opting to do in order to keep their 529 savings invested through this turbulent market period—you may want to consider first contributing the out-of-pocket amount to your student’s 529 plan to secure the tax deduction. The contribution can be invested in a money market or similar cash-based fund (it must be invested) and then immediately distributed, without penalty, to pay for the college expenses.

*Note: A 529 College Savings Plan should not be confused with a 529 Prepaid Tuition Plan, which can be used to prepay tuition at today’s rates for a future education at a qualified (usually public) school within a given state. More information about Prepaid 529 Plans is available HERE. Note: Virginia closed enrollment to its 529 Prepaid Tuition Plan in 2019.

Some Other 529 Perks You May Not Be Aware Of …

In addition to the tax and estate planning advantages of saving for college through a 529 plan, there are some less known ways that a 529 can be used to support your family’s education needs.

529 Funds for K-12 Private School Tuition

Beginning in 2018 with the enactment of the Tax Cuts and Jobs Act, families can make a tax-free 529 distribution—up to $10,000 per beneficiary per year—to fund K-12 private school tuition.

A more extensive discussion of the K-12 education funding option, along with a list of states offering tax deductions/credits for 529 contributions, can be found HERE.

Note: Not every state has conformed to the 529 K-12 funding provisions in the new tax law. In some states, earnings on 529 contributions used for K-12 tuition expenses may be subject to state income tax or recapture of tax deductions/credits—so make sure you understand the rules specific to the state 529 plan you are considering.

529 Funds for Overseas Study

Students interested in heading overseas for college can use 529 funds for qualified expenses if the educational institution they are enrolled in is eligible for Title IV federal student aid. Over 400 foreign schools meet this requirement. You can use the U.S. Department of Education’s Federal School Code Search tool to determine if a school qualifies.

Students may also be able to use their 529 savings to help pay for an academic study abroad program through a U.S.-based college or university. Again, the school must be Title IV eligible and grant academic credit for the program.

Note: The same 529 rules apply for qualified educational expenses when studying overseas. While tuition, room and board, books, and certain equipment/supplies are covered, transportation and travel expenses are not.

Funds for Independent Study During a “Gap Year”

A growing trend in the U.S. is for students to defer college and take a “gap year” to pursue an independent area of study or interest. If this exploration involves enrolling in a program affiliated with a qualified Title IV school, it may be possible to use 529 funds to defray qualified expenses.

Transferability of 529 Funds to Another Beneficiary

Let’s say your child decides to go to a public instead of private institution or chooses another path that doesn’t include college. What are your options if you have “extra” funds in your 529 plan?

For starters, you may want to hang onto it for at least a few years in case your child wishes to use the funds in the future for graduate school, technical school, or other training.

Another option is to change the beneficiary to a sibling or other qualified family member who will be attending post-secondary school, which can be done without tax implications. Some farsighted parents opt to hold onto the 529 plan for the education needs of future grandchildren. Maintaining the 529 for future qualified educational use will enable you to avoid paying taxes on earnings and the 10% penalty that applies if you take a distribution for non-qualified, non-educational expenses.

Note: If the 529 beneficiary receives a scholarship or attends a U.S. military academy, the 529 owner can withdraw an equivalent dollar value from the 529 penalty-free, but earnings are still taxable.

Using 529 Funds to Pay Off Student Loans

If a student takes out student loans to help pay for college, a 529 plan can be used to make a qualified distribution up to $10,000 (lifetime limit) for loan repayment.

Such a scenario might occur when there are left over 529 funds within a family that could be redeployed to help make payments on another family member’s loans. Someone might also make the calculus during a down market that taking out a loan in order to keep 529 invested for later distribution (and loan repayment) makes financial sense. Or someone with existing loans—perhaps a sibling or parent with older student loans—might open and fund a 529 specifically for the purpose of making loan payments and securing the state tax deduction.

************

If we can help you—or someone you know—plan and save for a child’s future education, please give us a call.

As with other investments, there are generally fees and expenses associated with participation in a 529 plan. This and other information about 529 plans is available in the issuers official statement and should be read carefully before investing. There is also a risk that these plans may lose money or not perform well enough to cover college costs as anticipated. Most states offer their own 529 plans, which may provide advantages and benefits exclusively for their residents. The tax implications can vary significantly from state to state. Favorable state tax treatment for investing in Section 529 college savings plans may be limited to investments made in plans offered by your home state. Investors should consult a tax advisor about any state tax consequences of an investment in a 529 plan.